The Savvy Retiree Digest

Archives

Understanding Home Equity: A Key to Financial Empowerment

SIGN UP FOR OUR NEWSLETTER

Understanding Your Home Equity: A Key to Financial Empowerment |

Discover how your home's value contributes to your financial well-being |

Have you ever wondered about the current value of your home and how it impacts your financial health?

Your home is likely your most significant financial asset, and over time, it has been quietly building wealth for you.

This accumulated wealth is known as home equity.

Home equity is the difference between your home's current market value and the remaining balance on your mortgage.

For instance, if your home is valued at $500,000 and you owe $200,000 on your mortgage, your equity amounts to $300,000.

According to recent data, the average U.S. homeowner with a mortgage has approximately $307,000 in home equity.

Several factors contribute to this substantial equity:

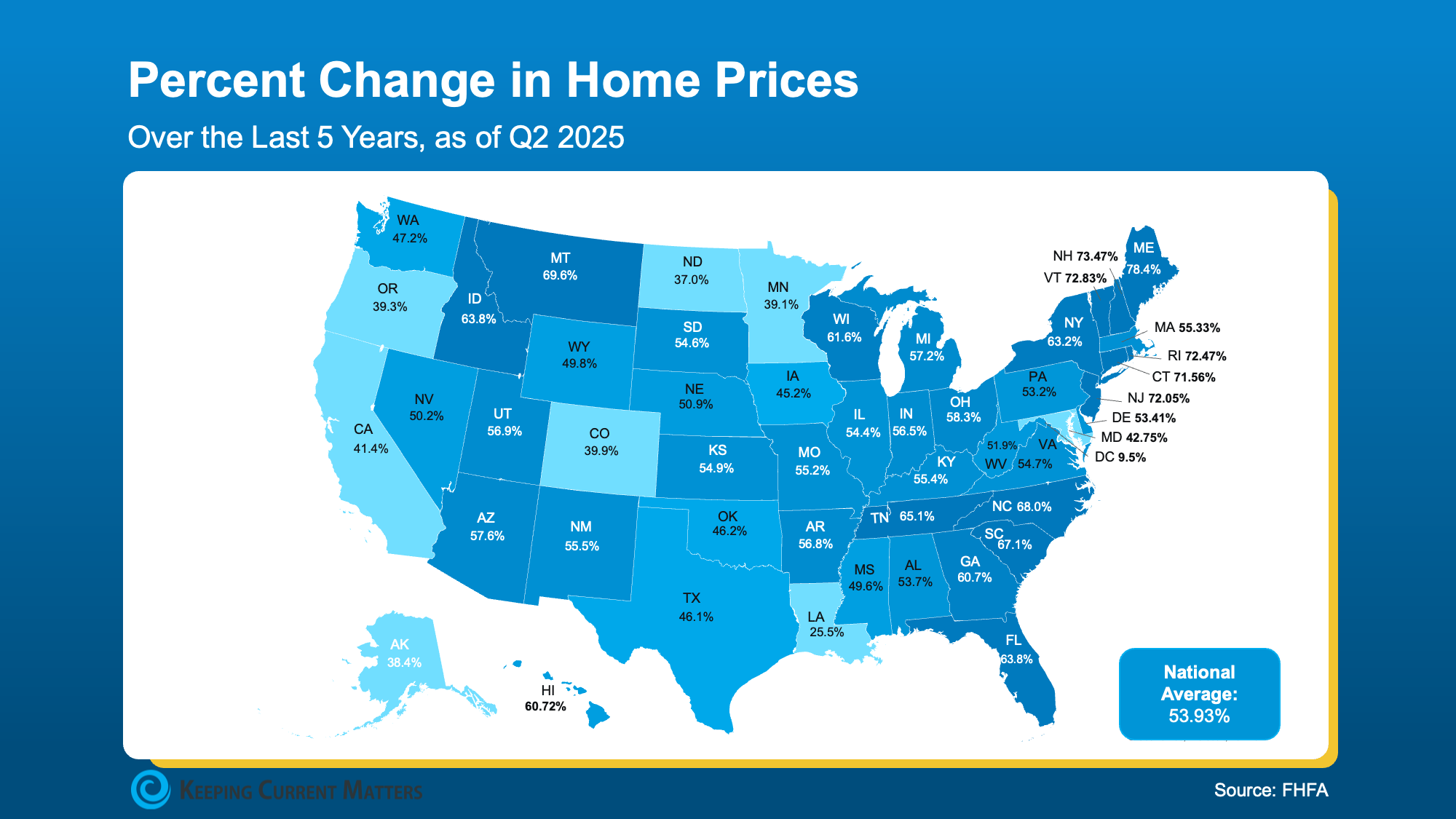

1. Home Price Appreciation: Over the past five years, home prices have risen significantly, leading to increased property values and, consequently, higher equity for homeowners.

2. Mortgage Payments: Regular mortgage payments reduce the principal balance, thereby increasing your ownership stake in the property.

Understanding your home equity is crucial, as it can serve as a financial resource for various purposes:

1. Purchasing a New Home: Equity can be used as a down payment for your next property, potentially reducing the need for additional financing.

2. Home Improvements: Investing in renovations can enhance your living space and may further increase your home's value.

3. Debt Consolidation: Utilizing home equity to pay off high-interest debts can lead to lower overall interest payments.

To accurately assess your home's current value and equity, consider consulting with a local real estate professional.

They can provide a comprehensive market analysis, helping you make informed decisions about your property and financial future.

Remember, your home is more than just a place to live—it's a significant component of your financial portfolio.

Regularly monitoring its value and understanding your equity position can empower you to make strategic financial choices. |