The Savvy Retiree Digest

Archives

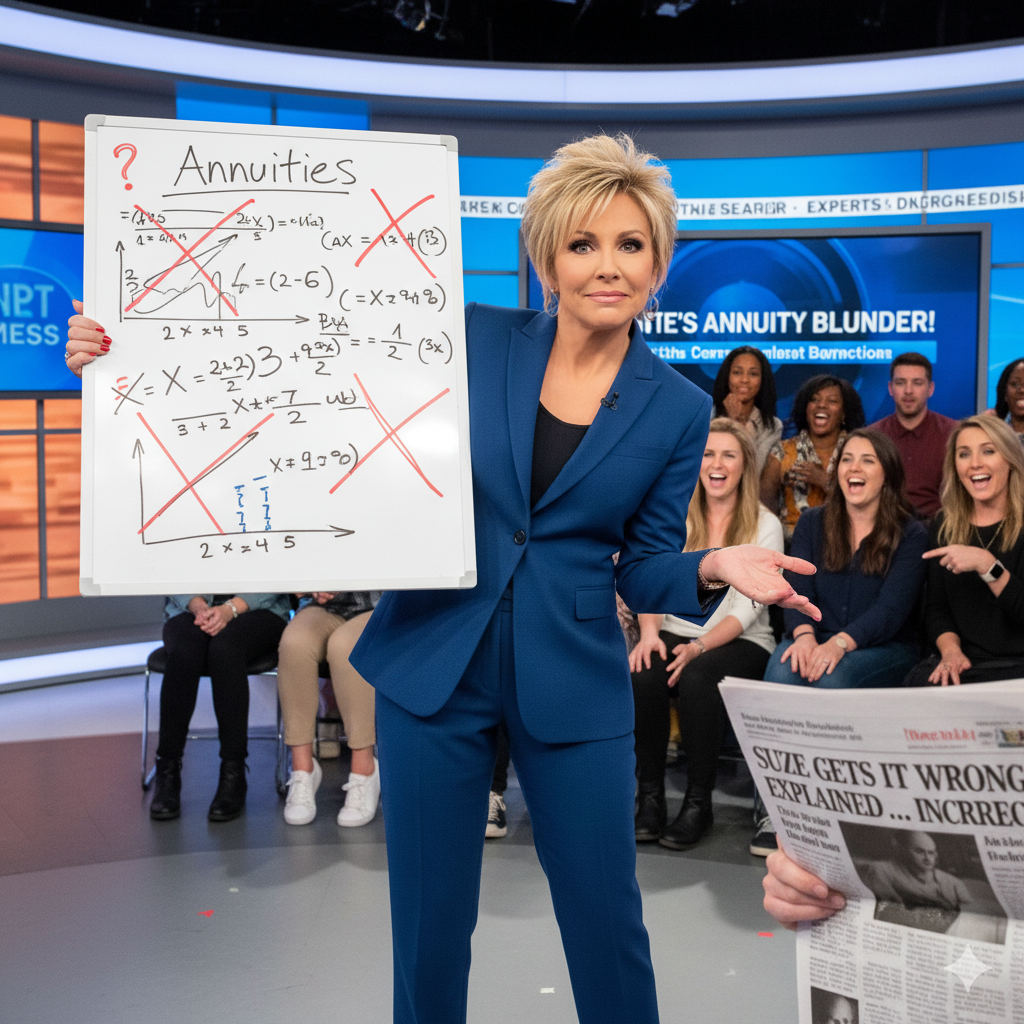

Annuity Boom: Securing Guaranteed Income in Retirement

SIGN UP FOR OUR NEWSLETTER

The Great Annuity Boom: Why Your Neighbors Are Suddenly Talking About Guaranteed Income |

Amid economic uncertainty, a surge in annuity popularity is reshaping retirement planning, driven by new products and a powerful demand for financial security. |

In an era of dizzying market swings, the humble annuity is making a remarkable comeback as a cornerstone of retirement planning.

It seems everyone is searching for a safe harbor from economic storms.

Record-breaking annuity sales over the past few years signal a massive shift in how people are approaching their financial future.

Many are tired of the anxiety that comes with market volatility and are now prioritizing predictability.

An annuity, which is a contract with an insurance company, is designed to provide a source of guaranteed income in retirement.

This renewed interest has been fueled by higher interest rates, which have made the returns on certain fixed annuities highly competitive.

But these aren't your grandparents' financial products.

Innovations like the Fixed Index Annuity (FIA) and Registered Index-Linked Annuities (RILAs) offer a blend of principal protection and the potential for growth tied to market indexes.

These modern options provide flexibility that appeals to a new generation of retirees.

Federal changes are also making annuities more accessible than ever.

Recent legislation, like the SECURE 2.0 Act, is making it easier for these products to be included in workplace 401(k) plans.

For anyone mapping out their retirement, understanding the role an annuity can play in a diversified strategy has become absolutely essential.

This isn't just a trend; it's a fundamental rethinking of what it means to secure a stable financial future. |