Required Minimum Distributions and RMD Rules in Long Island, New York

The Savvy Retiree Digest

Archives

Required Minimum Distributions and RMD Rules in Long Island, New York

SIGN UP FOR OUR NEWSLETTER

Required Minimum Distributions and RMD Rules in Long Island, New York |

Explore Roth ira conversion options and key factors from RMD rules |

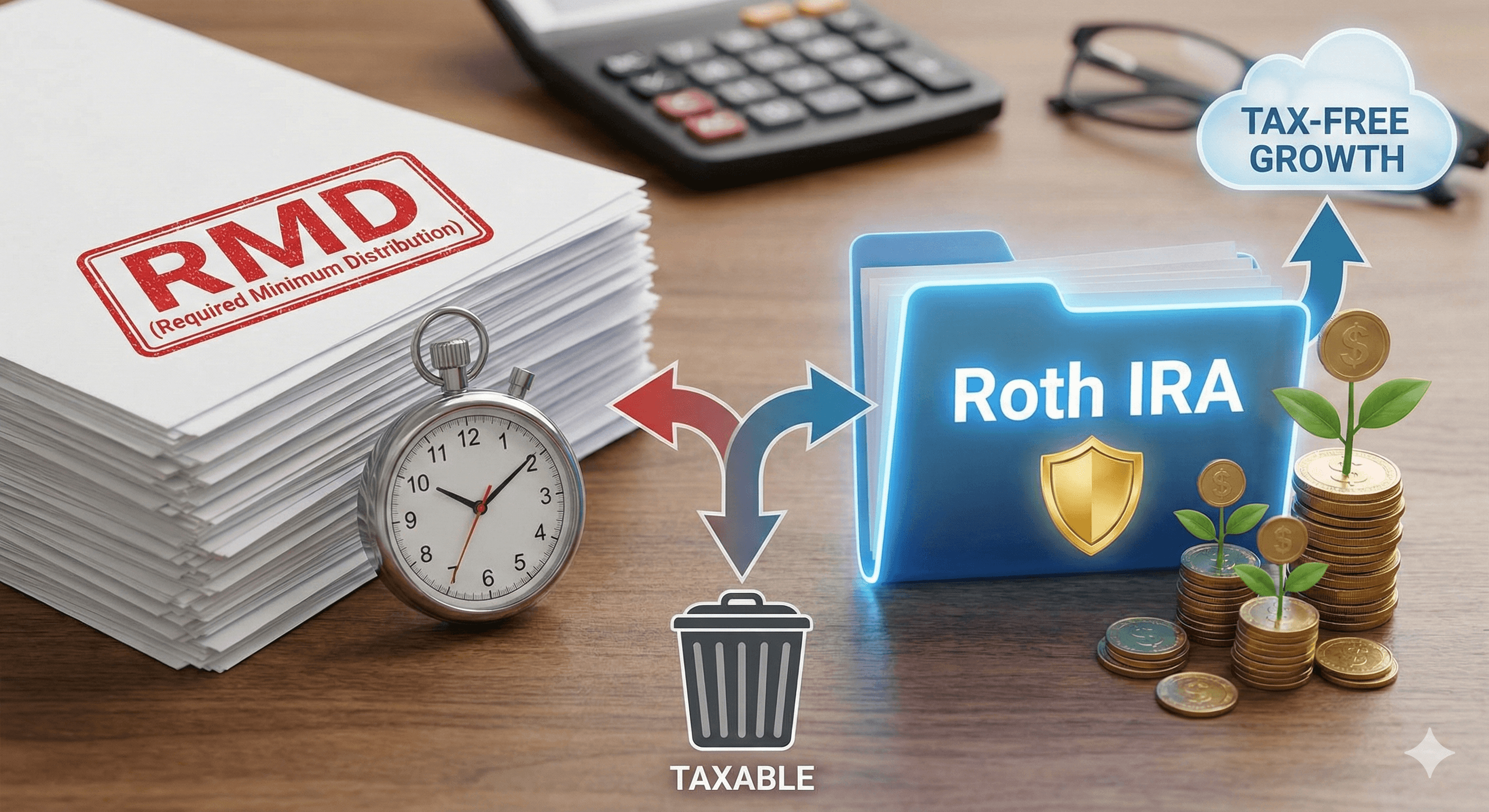

Residents of Long Island, New York, approaching retirement should be aware of the latest updates to required minimum distributions (RMDs) and Roth IRA conversion options. As of 2026, individuals must begin taking RMDs from tax-deferred retirement accounts at age 73. This change, part of the SECURE 2.0 Act, aims to provide retirees with more flexibility in managing their retirement savings. ([kiplinger.com](https://www.kiplinger.com/retirement/bipartisan-retirement-savings-package-in-massive-budget-bill?utm_source=openai))

It's important to note that RMDs cannot be directly transferred into a Roth IRA. The IRS mandates these distributions to ensure that taxes are paid on pre-tax contributions and earnings. However, individuals can perform a Roth IRA conversion by transferring funds from a traditional IRA to a Roth IRA. This process requires paying taxes on the converted amount in the year of conversion but offers the benefit of tax-free withdrawals in the future. ([irs.gov](https://www.irs.gov/retirement-plans/retirement-plan-and-ira-required-minimum-distributions-faqs?utm_source=openai))

For those considering a Roth IRA conversion, it's crucial to understand the tax implications. Converting a significant amount in a single year can push you into a higher tax bracket. Therefore, some financial advisors recommend a phased approach, converting smaller amounts over several years to manage tax liabilities effectively.

Long Island residents should also be aware of the penalties associated with failing to take RMDs. The SECURE 2.0 Act reduced the penalty from 50% to 25% of the missed RMD amount, and it can be further reduced to 10% if corrected promptly. ([kiplinger.com](https://www.kiplinger.com/retirement/bipartisan-retirement-savings-package-in-massive-budget-bill?utm_source=openai))

Given the complexities of RMD rules and Roth IRA conversions, consulting with a local financial advisor can provide personalized guidance tailored to your financial situation. They can help develop a tax-efficient retirement strategy that aligns with your goals and complies with current regulations.

In summary, while RMDs cannot be directly transferred to a Roth IRA, Long Island residents have options to manage their retirement savings effectively. Staying informed about the latest rules and seeking professional advice can help ensure a secure and tax-efficient retirement. |