The Savvy Retiree Digest

Archives

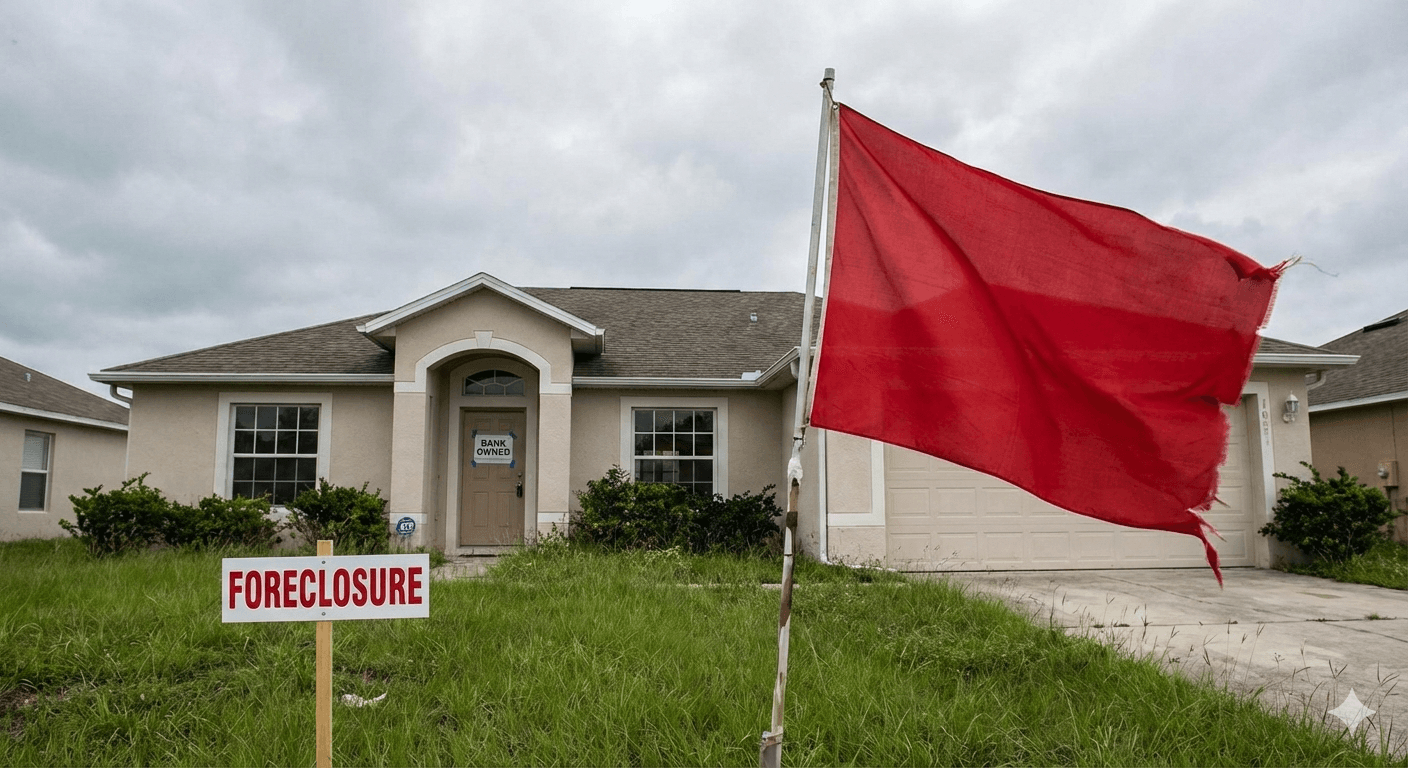

Rising Residential Foreclosures: Market Normalization Explained

SIGN UP FOR OUR NEWSLETTER

Rising Residential Foreclosures: A Sign of Market Normalization, Not Crisis |

Understanding the Recent Uptick in Foreclosure Activity |

Recent reports indicate a rise in residential foreclosures across the United States, prompting concerns about the health of the housing market.

However, a closer examination reveals that this increase is more indicative of a return to pre-pandemic norms rather than a looming crisis.

According to data from ATTOM, a leading real estate analytics firm, foreclosure filings in 2025 were reported on 367,460 U.S. properties.

This marks a 14% increase from 2024 and a 3% rise from 2023.

Despite these upticks, foreclosure activity remains 25% below 2019 levels and significantly lower than the peak of nearly 2.9 million in 2010.

Rob Barber, CEO at ATTOM, explains, "Foreclosure activity increased in 2025, reflecting a continued normalization of the housing market following several years of historically low levels."

He emphasizes that the current rise is driven more by market recalibration than widespread homeowner distress, with strong equity positions and disciplined lending practices continuing to limit risk.

Several factors contribute to this trend.

Homeowners are facing escalating costs, including sharp rises in property insurance premiums, which have climbed nearly 70% over the past five years to an average of $2,370 annually.

Additionally, property taxes, utilities, and maintenance expenses have increased, straining household budgets.

Job market slowdowns have further exacerbated the issue, with income loss triggering the majority of mortgage defaults.

Despite these challenges, the housing market's fundamentals remain solid.

Homeowners generally possess substantial equity, and lending standards have become more stringent since the 2008 crisis.

These conditions make a widespread housing collapse unlikely in 2026, though some markets could experience moderate corrections.

In summary, while the rise in foreclosures warrants attention, it does not signal an impending crisis.

Instead, it reflects a market adjusting back to normal levels after an extended period of unusually low foreclosure activity.

Homeowners and potential buyers should stay informed and consult with real estate professionals to navigate the evolving landscape. |