The Savvy Retiree Digest

Archives

"Age 100" Longevity: Are You Financially Prepared for a Longer Life?

SIGN UP FOR OUR NEWSLETTER

Living to 100 Is the New Reality. But Are You Financially Prepared for It? |

A shocking number of Americans now fear outliving their savings more than death itself, as the prospect of a 100-year lifespan creates a daunting new financial challenge. |

Living to age 100 is no longer a distant fantasy for a select few.

It is rapidly becoming a realistic possibility for millions of Americans, a testament to modern medicine and healthier lifestyles.

But this gift of longevity comes with a profound and unsettling question: are you prepared for it?

The number of centenarians in the United States is expected to quadruple to more than 400,000 by 2054.

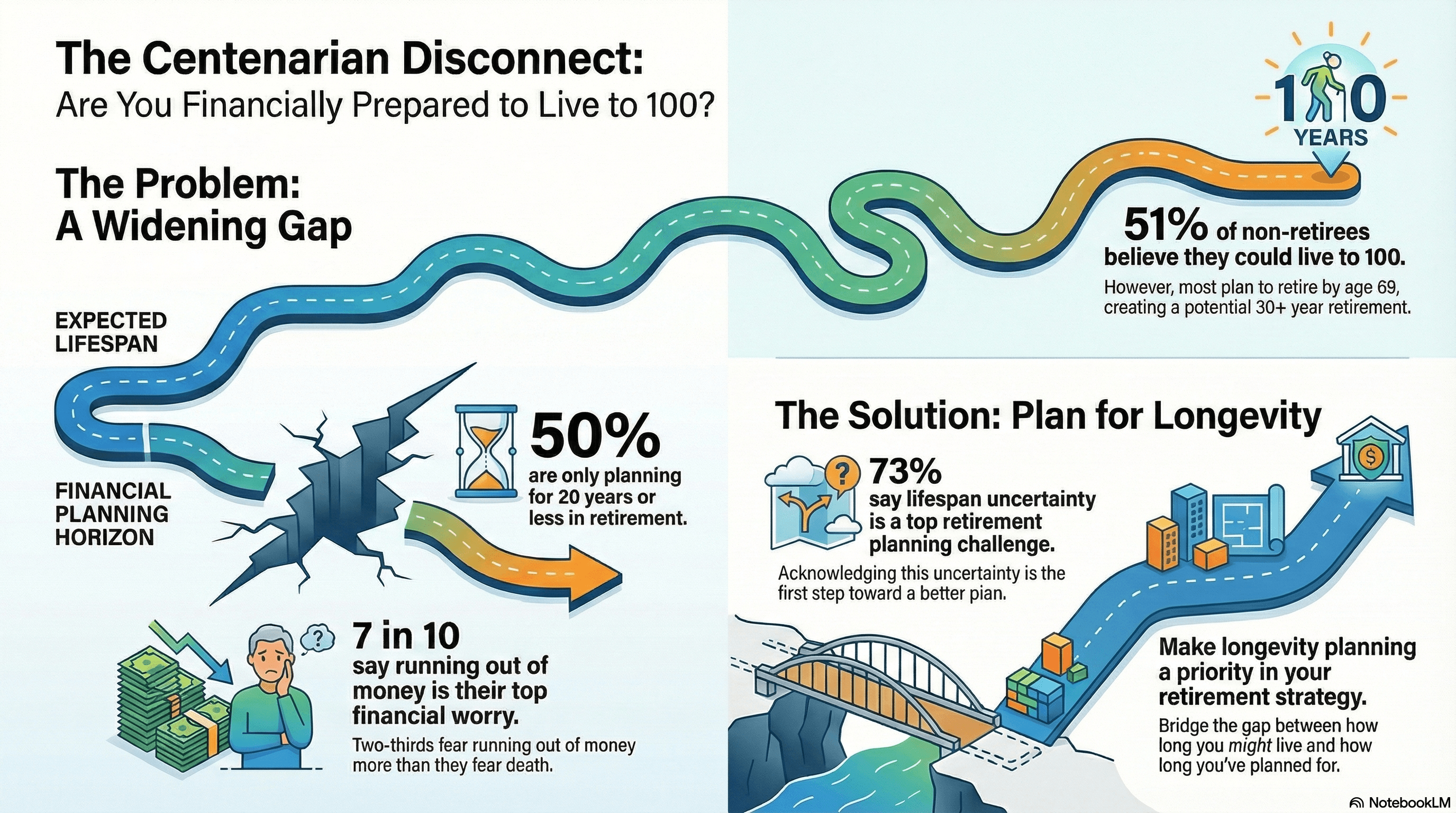

While many of us acknowledge we could live that long, a staggering disconnect exists between that awareness and our financial planning.

For a growing number of people, the fear of running out of money now outweighs the fear of death.

Recent studies show that nearly seven in ten people admit this is their single greatest financial worry.

This anxiety is not unfounded.

The vast majority of working Americans—a full 73%—say the uncertainty of their own lifespan is one of the biggest challenges in retirement planning.

This isn't just about numbers on a spreadsheet; it's about the deep, emotional need for security and dignity in our later years.

So, what truly provides financial confidence when facing a retirement that could last 30 or even 40 years?

It boils down to certainty in an uncertain world.

The single most important factor, according to retirees, is having a source of guaranteed monthly income in addition to Social Security.

This isn't about chasing market highs; it's about creating a reliable paycheck that you cannot outlive.

Three out of four people say that a guaranteed lifetime income stream would positively impact their happiness, their outlook on retirement, and their ability to simply enjoy life without constant financial stress.

Having a detailed, professional plan is the other cornerstone of confidence.

Working with a financial professional to map out essential and discretionary expenses provides a clear roadmap, transforming abstract fear into a concrete strategy.

The prospect of living to age 100 demands a new conversation around retirement.

It forces us to confront our deepest financial anxieties.

The time for longevity planning is now, pushing this critical issue to the absolute forefront of every retirement discussion.

It's an opportunity not just to secure your future, but to build a life of confidence and peace of mind, no matter how many birthdays you celebrate. |