The Savvy Retiree Digest

Archives

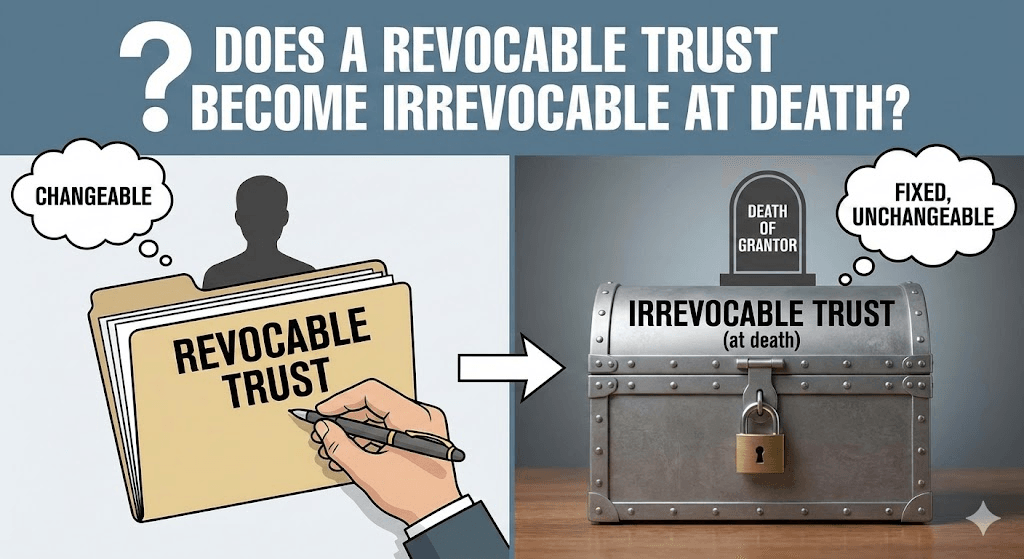

Does a Revocable Trust Become Irrevocable After Death?

SIGN UP FOR OUR NEWSLETTER

Understanding the Transition: Does a Revocable Trust Become Irrevocable After Death? |

Exploring the Implications of a Revocable Trust's Status Change Upon the Grantor's Passing |

A revocable trust, often referred to as a living trust, is a legal arrangement that allows the grantor to manage and control assets during their lifetime, with the flexibility to modify or dissolve the trust as circumstances change.

Upon the death of the grantor, this trust typically becomes irrevocable, meaning its terms are set and cannot be altered.

This transition ensures that the grantor's wishes are honored without deviation.

For instance, consider a retiree who establishes a revocable trust to manage their assets.

During their lifetime, they can adjust the trust's terms as needed.

However, upon their passing, the trust becomes irrevocable, and the successor trustee is obligated to distribute assets according to the original instructions.

It's important to note that while the general rule is that a revocable trust becomes irrevocable upon the grantor's death, certain provisions within the trust document or specific state laws may allow for limited modifications under particular circumstances.

Therefore, consulting with an estate planning professional is advisable to understand the nuances applicable to your situation.

In summary, a revocable trust offers flexibility and control during the grantor's lifetime.

Upon their death, it typically becomes irrevocable, solidifying the distribution plan for the assets and ensuring the grantor's intentions are carried out as specified.

|