The Savvy Retiree Digest

Archives

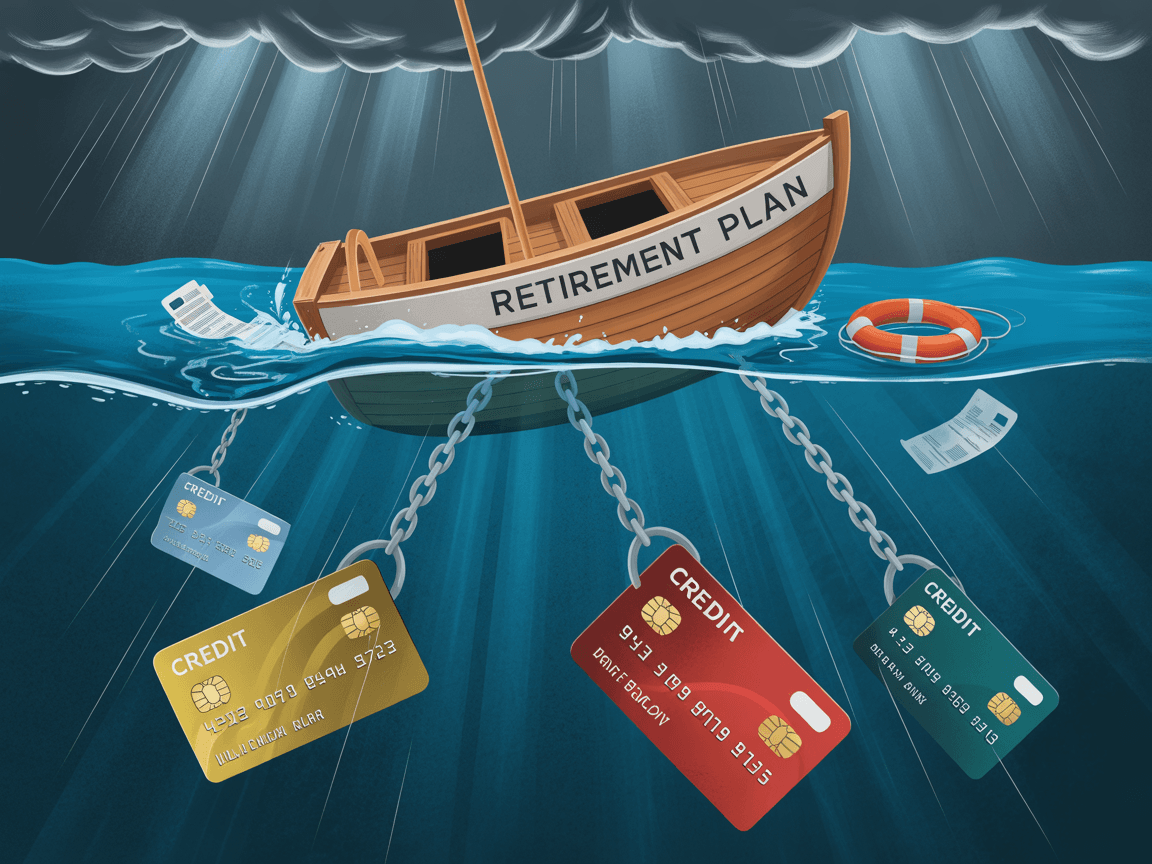

J.P. Morgan Highlights Credit Card Debt as Major Retirement Obstacle

SIGN UP FOR OUR NEWSLETTER

J.P. Morgan Highlights Credit Card Debt as Major Retirement Obstacle |

New study reveals nearly half of retirement plan participants carry credit card debt, impacting their financial security |

A recent study by J.P. Morgan Asset Management has unveiled a concerning trend: nearly 48% of individuals enrolled in retirement plans are burdened with credit card debt. This financial strain significantly increases the likelihood of these participants resorting to loans from their retirement accounts, potentially jeopardizing their long-term financial stability.

The "Retirement by the Numbers" report indicates that substantial credit card balances are closely linked to reduced contribution rates and diminished account balances. For older participants, this correlation can lead to a decrease in retirement readiness by up to 40%. The study's comprehensive analysis draws from data encompassing 16,000 defined contribution plans and over 12 million participants, offering a robust perspective on the challenges facing today's workforce.

Financial health extends beyond mere savings; external pressures like credit card debt directly influence saving behaviors and long-term security. This underscores the necessity for plan sponsors to design features that align with real-world participant behaviors, aiming to enhance retirement outcomes.

The study also highlights that average retiree spending declines by more than 30% between ages 60 and 85. However, spending can fluctuate dramatically, with 60% of new retirees experiencing annual changes of 20% or more. Notably, increasing contributions by just one percent starting at age 25 can help fund nine years of average Medicare-related expenses.

These findings challenge conventional thinking around static income replacement rate assumptions. They emphasize the importance of flexible, personalized retirement solutions to address the diverse needs of participants.

In light of these insights, it's imperative for individuals to assess their financial health comprehensively. Addressing credit card debt proactively can enhance one's ability to contribute consistently to retirement plans, thereby securing a more stable financial future. |