"Unlock Your Home's Equity: The Secret to Safe Aging in Place with Reverse Mortgages"

The Savvy Retiree Digest

Archives

"Unlock Your Home's Equity: The Secret to Safe Aging in Place with Reverse Mortgages"

SIGN UP FOR OUR NEWSLETTER

How A Reverse Mortgage Can Help You Age In Place Safely |

Learn how a reverse mortgage can help you age in place safely—boost cash flow, fund home safety upgrades, and cover care—while protecting you and your heirs. |

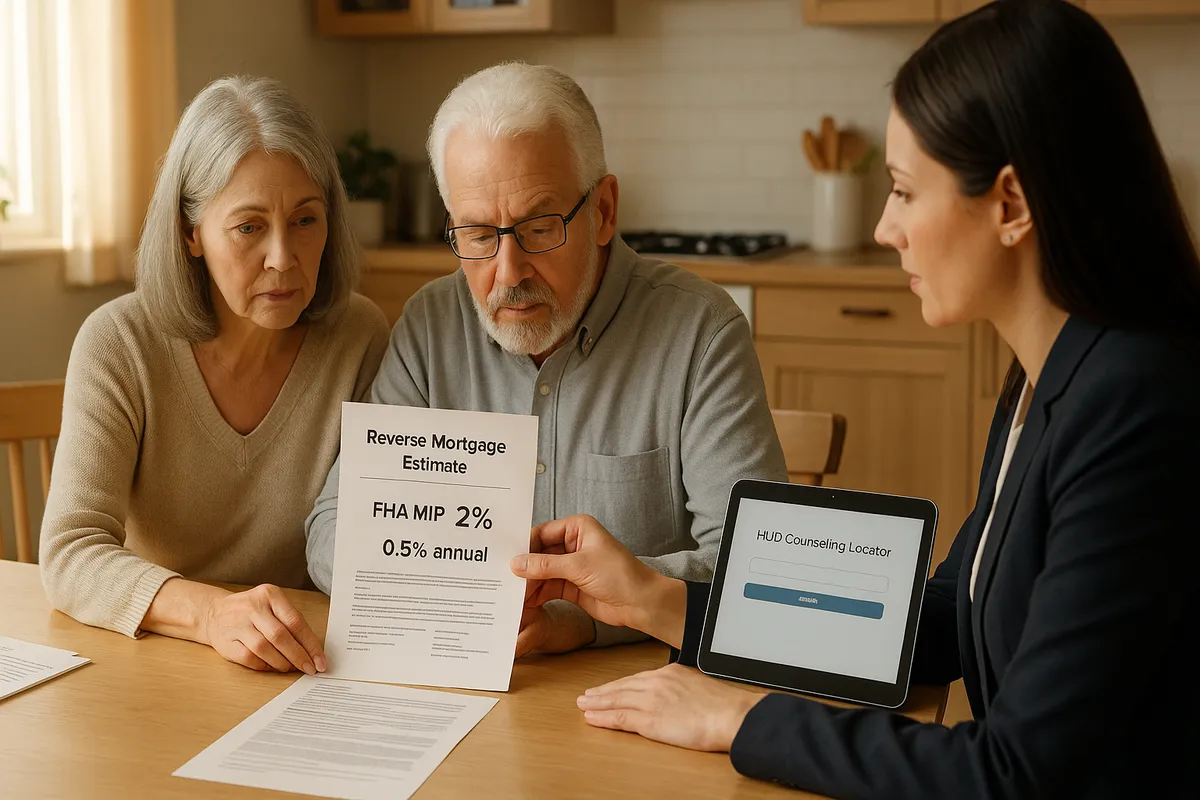

Staying in the home you love is possible—without straining your monthly budget. A reverse mortgage can turn part of your home equity into cash while you remain the owner. For many retirees, that means breathing room for essentials, safer home upgrades, and flexibility when surprises pop up. A Home Equity Conversion Mortgage (HECM) is the FHA‑insured version of a reverse mortgage backed by the federal government, giving borrowers key protections you don’t get with other loans, according to HUD’s HECM program page. Used thoughtfully, it can help you delay claiming Social Security—boosting your benefits by up to 8% per year you wait until age 70, per Social Security’s delayed retirement credits.

This guide explains how a reverse mortgage works, eligibility and costs, how to use funds for care and safety, and the safeguards for you and your heirs. The goal is simple: age in place safely and confidently.

Considering a reverse mortgage? Start with your goals. List your must‑haves (safety, monthly cash flow, care needs), then read on to see where a HECM fits.

What Is a Reverse Mortgage? How It Works for Retirees

With a HECM, you can receive funds as a lump sum, a monthly payment, a line of credit, or a combination. Interest and fees are added to the loan balance instead of you making monthly payments. You must still pay property taxes, homeowners insurance, HOA dues (if any), and maintain the home. The loan becomes due when you move, sell, or no longer meet program obligations. For an unbiased overview, see the CFPB’s reverse mortgage basics.

A simple example helps. Suppose Linda, age 72, has a paid‑off $400,000 home. She opens a HECM line of credit to cover emergencies and small monthly extras. She owes nothing monthly on the reverse mortgage, stays in her home, and only borrows (and pays interest on) what she uses.

HECM Reverse Mortgage for Seniors: Eligibility, Costs, and Protections

The big picture: protections are built in, but you still need to compare offers, read every fee line, and confirm you can comfortably meet taxes, insurance, and maintenance. Using Home Equity to Supplement Retirement Income (Without Moving)

You choose how to receive funds. A tenure payment can act like a monthly stipend for basics. A line of credit can sit unused until you need it—and unused credit can grow over time under the HECM rules. Research from the Center for Retirement Research at Boston College suggests reverse mortgages can improve retirement security when used strategically.

Income Strategies That Work

Stay tuned for Part 2 |