Reverse Mortgage Terms Explained for Long Island, New York

Understand reverse mortgage terms, including Home Equity Conversion Mortgage (HECM), repayment structures, and key terminology for Long Island homeowners.

Larry Speir

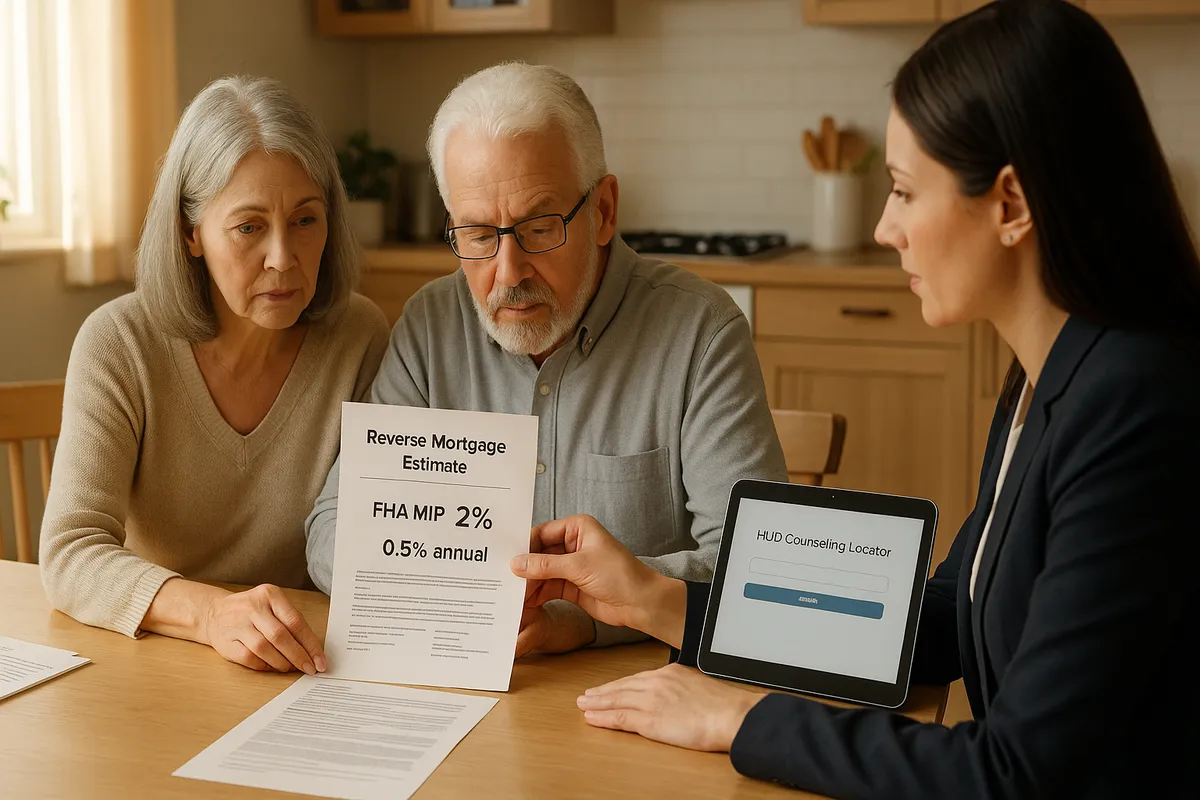

Feb 23, 2026Long Island homeowners are increasingly tapping their home equity through reverse mortgages, especially the Home Equity Conversion Mortgage (HECM), to support retirement income.

Unlike traditional loans, HECMs don’t require monthly payments, so the balance grows as interest accrues, though borrowers still must cover property taxes, insurance, and upkeep.

Missing these homeowner obligations can result in foreclosure, a rising concern for Suffolk County seniors.

HECMs typically feature adjustable rates, which affect the total amount owed and allow flexible access—like monthly payments or credit lines.

Key terms such as Principal Limit Factor, Mandatory Obligations, and Non-Recourse Protection help clarify borrower benefits and responsibilities.

Understanding how these factors interplay is vital for protecting your home and financial security.

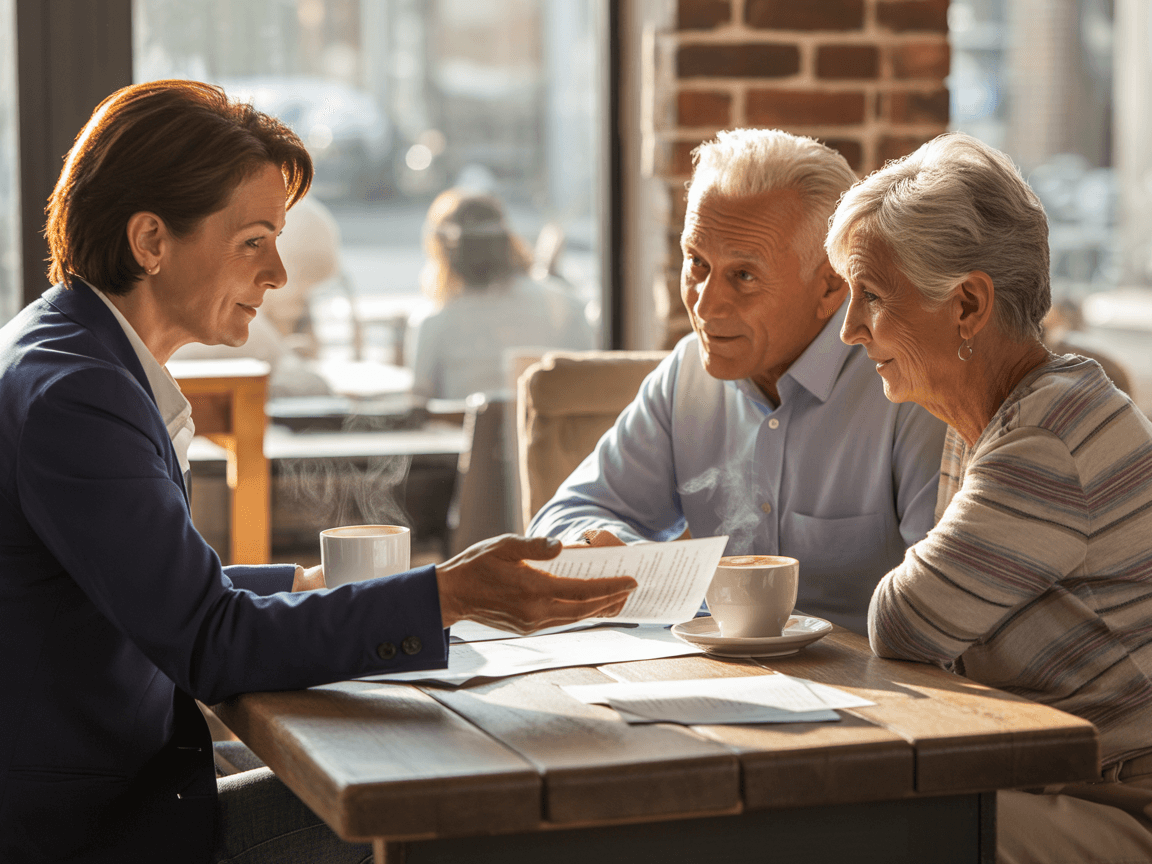

Seeking guidance from a financial advisor or HUD-approved counselor ensures informed, confident decisions on reverse mortgages in Long Island.